When it comes to your investment portfolio, we take a very different approach than most wealth management firms. Most advisors begin with an arbitrary risk-tolerance questionnaire then, invest your hard-earned wealth in an overly diversified, static, cookie-cutter portfolio. To make it worse, these types of portfolios are often constructed using best-guess estimates and feelings.

At Lake Hills, we believe your portfolio should be constructed based on what drives market returns, math, market signals, and economic data. Being data dependent puts you in the best position to generate positive returns while eliminating the biggest enemies to successful investing which are fear and greed.

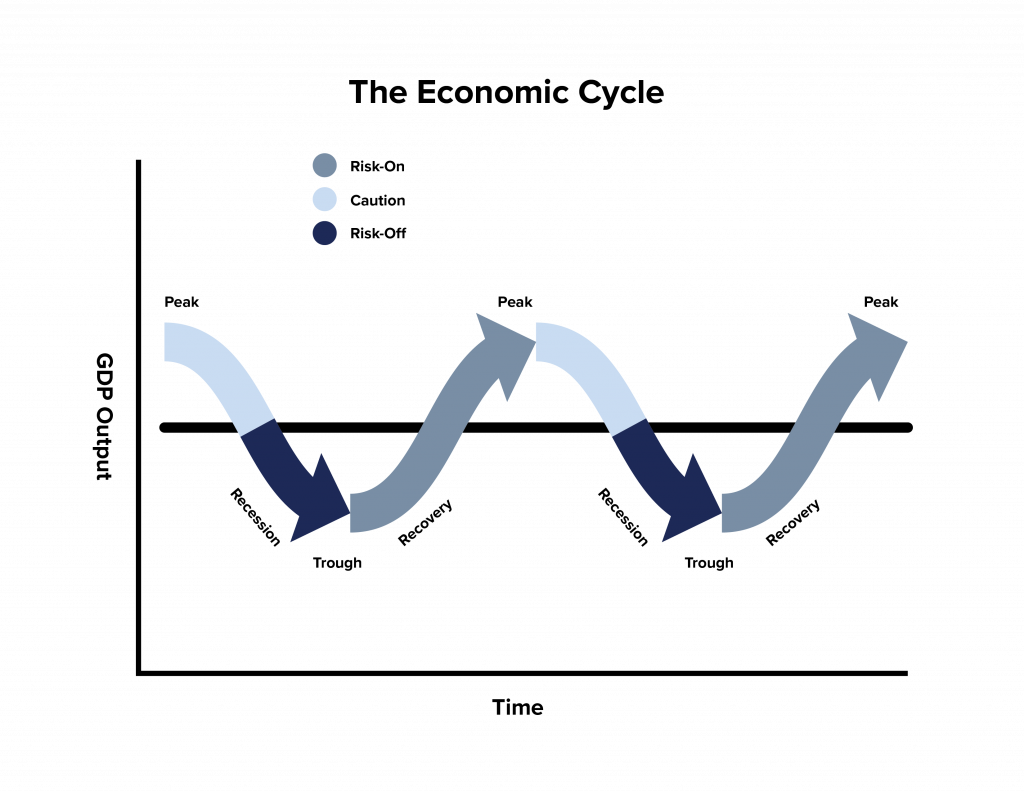

Our Adaptive Investment Strategies works by using proprietary indicators that use statistical outcomes, suggesting when and what type of investments you should own. These indicators are also designed to be an early warning mechanism when market decline risk is elevated, and a more cautious or conservative investment strategy is warranted.

How it works:

-

Analyze and Selection

We will lay the foundation for your portfolio by understanding your financial goals and what returns are required to meet these goals.

-

Portfolio Construction

Knowing your goals, timeline, and required returns, we then construct your portfolio using low-cost, tax-efficient investments such as exchange-traded funds and individual stocks.

-

Monitor and Make Changes

Using our proprietary data-driven indicators, the goal is to optimize your portfolio as needed in order to grow and protect your wealth.

-

Review and Update

We will meet with you on a regular basis to review your finances and goals to ensure you remain invested in the ideal portfolio.